WHAT WE CHECK

ON A STANDARD HOME INSPECTION

A standard Scharf Home Inspection is a non-invasive, visual inspection of a structure. It is conducted by a certified professional, who will look for defects or issues with the structure and its components, then provide you with a digital photo report for your review. Our standard inspection covers over 1,800 items, included in the categories below.

ABOUT US

RESPONSIVE SOLUTIONS FOR YOUR HOME, BUILDING OR BUSINESS.

At Scharf Inspections, we guarantee the best service and support. With thousands home inspections, we have learned from experience what it means to serve our customers. We exceed all standards and will work with you to get the most thorough inspection possible. Thorough inspection of over 1,800 items Friendly & knowledgable staff Excellent customer service support Certified inspectors with years of expereince. The most advance technology & practices Reports within 24 Hours after inspection

CLIENT'S TESTIMONIALS

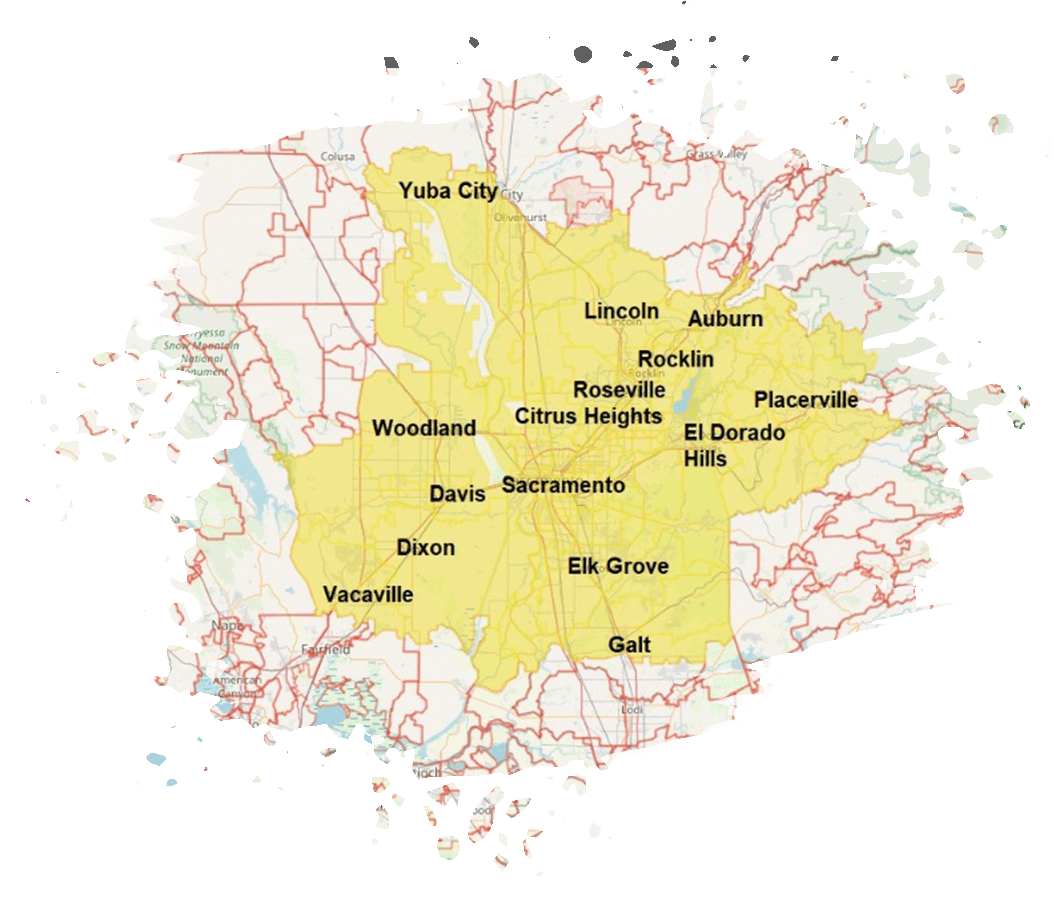

Scharf Inspections offers its service in The Greater Sacramento area

and its surrounding counties, covering;

we guarantee the best inspection services with comprehensive reports.

10 reasons to get a home inspection, even if you’re on a tight budget.

1. Peace of mind – The number one reason to get a home inspection is peace of mind. Knowing that your home has been inspected by a professional and that any potential problems have been identified gives you the confidence to move ahead with the purchase.

2. Safety – A home inspector will look for safety hazards such as frayed wiring, lead paint, and structural damage that could cause accidents or injuries down the road.

3. Avoid costly repairs down the road – Many expensive repairs can be avoided by catching them early with a home inspection. Problems like termite damage, roof leaks, and faulty plumbing can all be fixed before they turn into bigger (and more expensive) issues.

4. Identify hidden costs – Sometimes what looks like a great deal on a house can quickly become not-so-great when you factor in the cost of repairs needed to bring it up to code. A home inspector will identify these hidden costs so you know exactly what you’re getting into before making an offer on a property.

5. Buying a home is one of the biggest decisions you’ll ever make. That’s why it’s important to get a home inspection before making an offer.

A home inspection can reveal critical information about the condition of a home and its systems. This makes the buyer aware of what costs, repairs and maintenance the home may require immediately, and over time. If a buyer isn’t comfortable with the findings of the home inspection, it usually presents one last opportunity to back out of the offer to buy.

By getting a quality home inspection, you’re ensuring that you won’t have any nasty surprises after buying your new house. You’ll know exactly what needs attention – and what doesn’t – so you can budget for repairs accordingly. Plus, our inspectors are highly experienced and will provide you with an in-depth report on their findings.

6. A home inspection can detect safety issues like radon, carbon monoxide, and mold. Make sure that your home-buying contract states that should such hazards be detected, you have the option to cancel the offer to buy. This is not only for your own protection but also for the protection of future occupants of your new house.

You’ll want to know about any potential dangers lurking in your new home before it’s too late! Don’t let yourself or anyone else get hurt by these hazardous conditions because they were never tested for in the first place. Protect yourself and others with this simple test! It could save lives!

7. Before you purchase your dream home, be sure to have it inspected for any illegal additions or installations. These could affect the value of the house as well as its insurability and tax status. It’s better to know about these things before you buy than after.

8. A home inspection is one of the most important steps in the buying process. By getting a professional home inspection, you’ll know exactly what you’re getting into before you buy. And if you’re buying an “as-is” property, a home inspection is even more critical.

At Scharf Inspections, we want to make sure that you have all the information you need to make the best decision for your family. That’s why we offer comprehensive home inspections that include a review of the property’s condition, as well as a report on any potential hazards or problems. We also have a team of specialists who can help you remedy any issues that are found during the inspection.

9. Uncover Safety Issues.

That’s why it’s important to have a home inspection done before you buy. A home inspector will look for any and all potential problems with the property so that you know what you’re getting into. No one wants to purchase a home and then find out that they need to spend tens of thousands of dollars on repairs. By having a home inspection, you can avoid this costly mistake. The inspection is an important part of the process and should be taken seriously. It’s not just about finding out what needs to be fixed, but also about learning more about your potential future home. A professional inspector will go through every inch of your house and provide you with a detailed report on any issues they find. They can even help you prioritize which repairs should take place first so that you can get started right away! Don’t waste time worrying if there are any problems with your soon-to-be dream home – let us do all the work for you! We offer free inspections in order to give our customers peace of mind when it comes to their homes. You won’t have to worry anymore because we will tell you everything that needs fixing before closing day arrives! Let us save you money by helping prevent costly surprises after moving into your new home.

10. We do not offer pest inspection. However, a pest inspection is recommended on all houses before close of escrow. There are many to choose from online.

Pests and insects can cause major problems in your home. If left untreated, they can damage the structure of your home, as well as contaminate it with harmful bacteria. Termites are one of the most common pests that people deal with on a daily basis. They are known to cause approximately five billion dollars in damages yearly. Don’t let pests and insects ruin your property! Call us today for an inspection or visit our website to learn more about how we can help you protect your family from these dangerous creatures!